Orbyfy™️ is Google Earth meets Risk Analytics

Orbyfy Physics-AI Digital Twins™️

From climate risks to real world resilience.

Making climate risk impact data accessible, as easy as searching for an address. Period.

We translate climate risks into climate forces to determine actual impacts and damages on buildings, infrastructures, and homes.

Empower your organization with explainable, city-scale simulations that translate climate hazards into actionable insights—whether you’re safeguarding the grid, underwriting portfolios, or fortifying buildings.

Mission & Vision

Our Mission

To equip utilities, financial institutions, real-estate investors, and infrastructure owners with physics-grounded digital twins that demystify climate hazards and enable data-driven resilience strategies.

Our Vision

A world where every community, asset, and portfolio is shielded from extreme weather and climate extremes—achieved through transparent, first-principles modeling that bridges the divide between “what if” and “act now.”

Why Orbyfy Physics-AI Digital Twins™️

Physics-First Explainability

Our Physics AI neural networks are constrained by fundamental partial differential equations—no “black-box” guesses. Every flood map, fire spread, and wind loading scenario is backed by rigorous fluid, structural, and thermal dynamics.

City-Scale, Real-Time Insights

Model entire urban domains (up to 40,000 km²) with sub-kilometer resolution. Ingest real-time weather feeds, historic datasets and asset layers, and produce up-to-the-minute risk scores—delivered via browser or API.

Actionable Outputs for Any Stakeholder

From grid planners to underwriters to property managers, Orbyfy’s digital twins generate geolocated hazard layers, financial KPIs, loss estimates, and mitigation roadmaps—enabling confident decisions under uncertainty.

Seamless Integration

Export GeoJSON, CSV, or plug directly into GIS, underwriting systems, portfolio dashboards, or asset-management platforms. No heavy compute infrastructure needed—just our low-latency Data-as-a-Service API.

Orbyfy Physics-AI Digital Twins™️

Geolocate climate risks. As easy as searching for an address on Google Maps.

Our solutions

-

Orbyfy Aqualyt™ Flood Risk Digital Twin

“Rising Waters, Resilient Cities.”

Overview:

Shallow-water and infiltration PDEs embedded in neural networks produce real-time flood inundation maps at 10-, 50-, and 100-year return periods.

Integrates precipitation forecasts, soil moisture profiles (5 cm and 1 m depths), elevation, impervious surfaces, river discharge, and historic flood events.

Delivers flood-depth rasters, expected-loss KPIs (ASCE 24-14, FEMA HAZUS-MH), and geolocated damage categorizations for every structure and critical facility.

Key Benefits:

Mitigate substation and critical-infrastructure flooding: reduce downtime by 40% and avoid $30 M/year in equipment losses.

Inform bank stress-tests and loan underwriting with physics-backed PD/LGD curves, reducing unexpected credit losses by 15%.

Guide city planners to invest $1 in hazard mitigation to save up to $6 in future recovery costs.

-

Orbyfy Ignite™ Wildfire Risk Digital Twin

“Ignite Insight. Extinguish Risk.”

Overview:

Physics-Informed Neural Networks governed by advection–diffusion–reaction equations simulate fire intensity, ember transport, and heat diffusion.

Real-time and forecast weather, fuel loads, elevation, building footprints, and grid infrastructure feed into city-scale wildfire spread models.

Generates geolocated fire-intensity fields, proximity-based risk scores, and damage categorizations for every home, substation, and transmission corridor.

Key Benefits:

Pinpoint high-risk line segments for targeted vegetation management—reducing ignition events by up to 60%.

Underwrite portfolios with hyper-local fire-exposure metrics, improving combined loss ratios by 5–10%.

Prioritize retrofit and suppression investments: $3 saved in avoided damages for every $1 spent.

-

Orbyfy Physics-AI™ Platform

“Turning First Principles into Financial KPIs.”

Overview:

Foundational Physics-AI framework that constrains every neural network to the governing equations of fluid flow, heat transfer, and structural mechanics.

Common engine powering all “Ignite,” “Aqualyt,” and future modules—whether modeling hail damage on solar assets or hurricane wind-pressure loads on skyscrapers.

Transparent model architecture ensures that stakeholders can trace every risk score back to real-world PDEs.

Key Benefits:

Build custom “What-If” simulations in days, not months—without specialized HPC clusters.

Seamlessly plug into existing analytics pipelines: export GeoJSON/CSV layers, tabular KPIs, or call via API.

Future-proof your climate-risk strategy: add new hazards (e.g., hail, heat waves) on the same Physics-AI backbone.

Orbyfy Physics-AI

Digital Twins™️

Geolocate climate risks. As easy as searching for an address on Google Maps.

Our industries

-

Power Utilities

“GridGuard™ Physics-AI Twins Fueling Utility Resilience”

Distribution Resilience: Targeted vegetation management to slash wildfire ignitions by 60%.

Transmission Planning: Span-level failure probabilities under 100-year wind or ice loads—avoiding $50M in storm damage.

Substation Flood Protection: Site-specific inundation forecasts reduce downtime by 40% and save $30M/year.

Outage Management: Pre-deploy crews based on real-time hazard overlays, cutting restoration times by 25% and saving $5M per season.

-

Banking & Insurance

“FinanceGuard™ Turning Climate Uncertainty into Capital Assurance”

Regulatory Stress-Testing: Run SEC/OCC/ECB scenarios in minutes; cut excess capital buffers by 20%.

Precision Underwriting: Asset-level flood and fire intensities improve combined ratios by up to 10%.

Portfolio Resilience: Track mortgages and policies in high-risk zones; adjust reserves proactively, reducing unexpected losses by 15%.

-

Real Estate & Building Portfolios

“PropertyShield™ Physics-AI Twins for Resilient Portfolios”

Due-Diligence Risk Assessment: Simulate flood depths and ember-spotting at prospective sites—cut acquisition surprises by $1.2M per high-risk property.

Continuous Monitoring & Reporting: Automate TCFD/SASB/SEC-ready disclosures—halve quarterly update cycles and lower cost of capital by 10 bps.

Retrofit Prioritization: Rank properties by “avoided loss per dollar invested,” boosting ROI on resilience spend by 35% and cutting portfolio-wide expected loss by 40%.

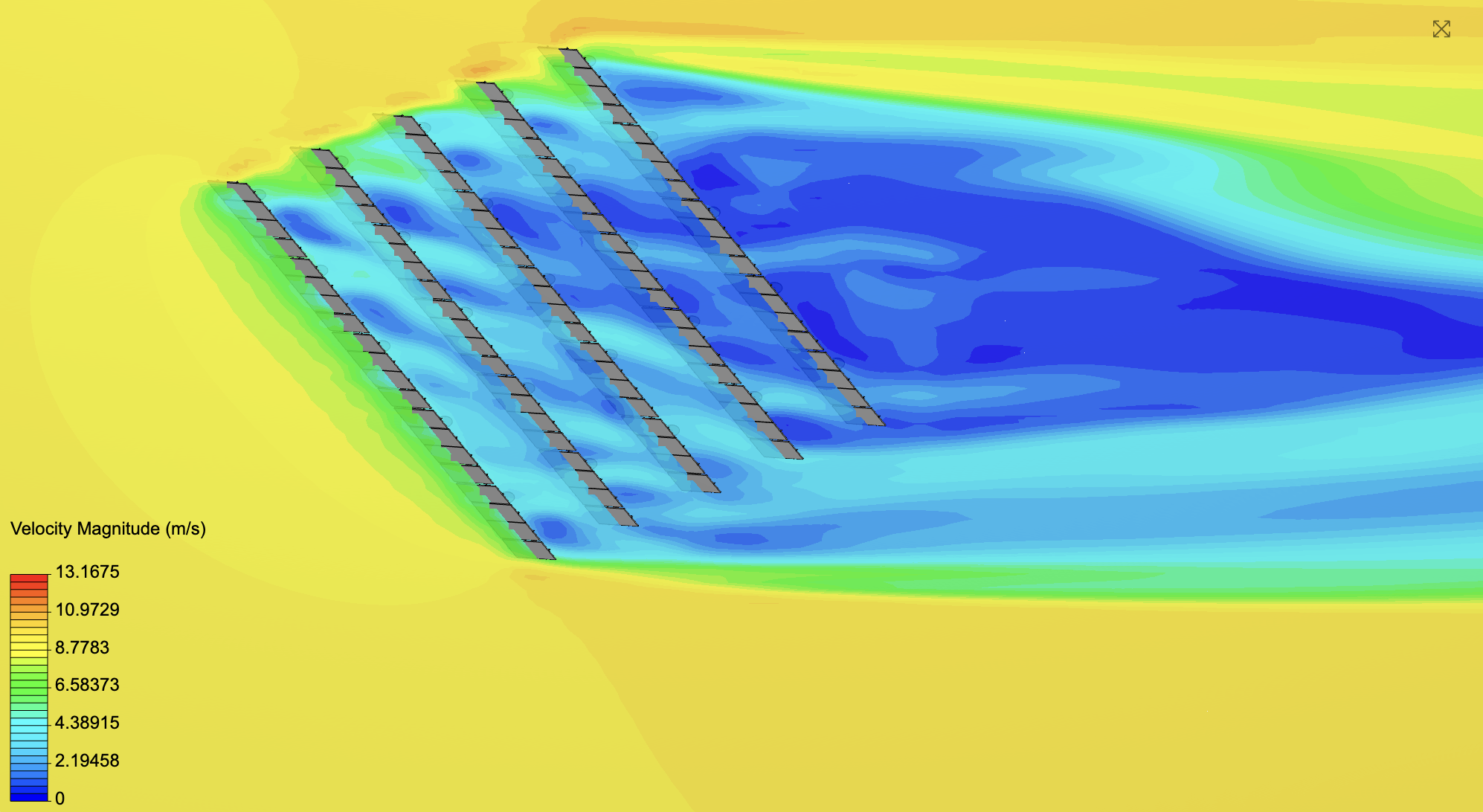

Flood simulation

Precise flood inundation modeling using Orbyfy’s 3D models of cities including changes of depth and topography. Quantify the depth and extent of potential flooding for specific assets, area of inundation, leading to more accurate risk scores. Address the level of damage to buildings, structures, and homes.

Modeling of Calgary’s Bow river and 1-in-100 year storm event.

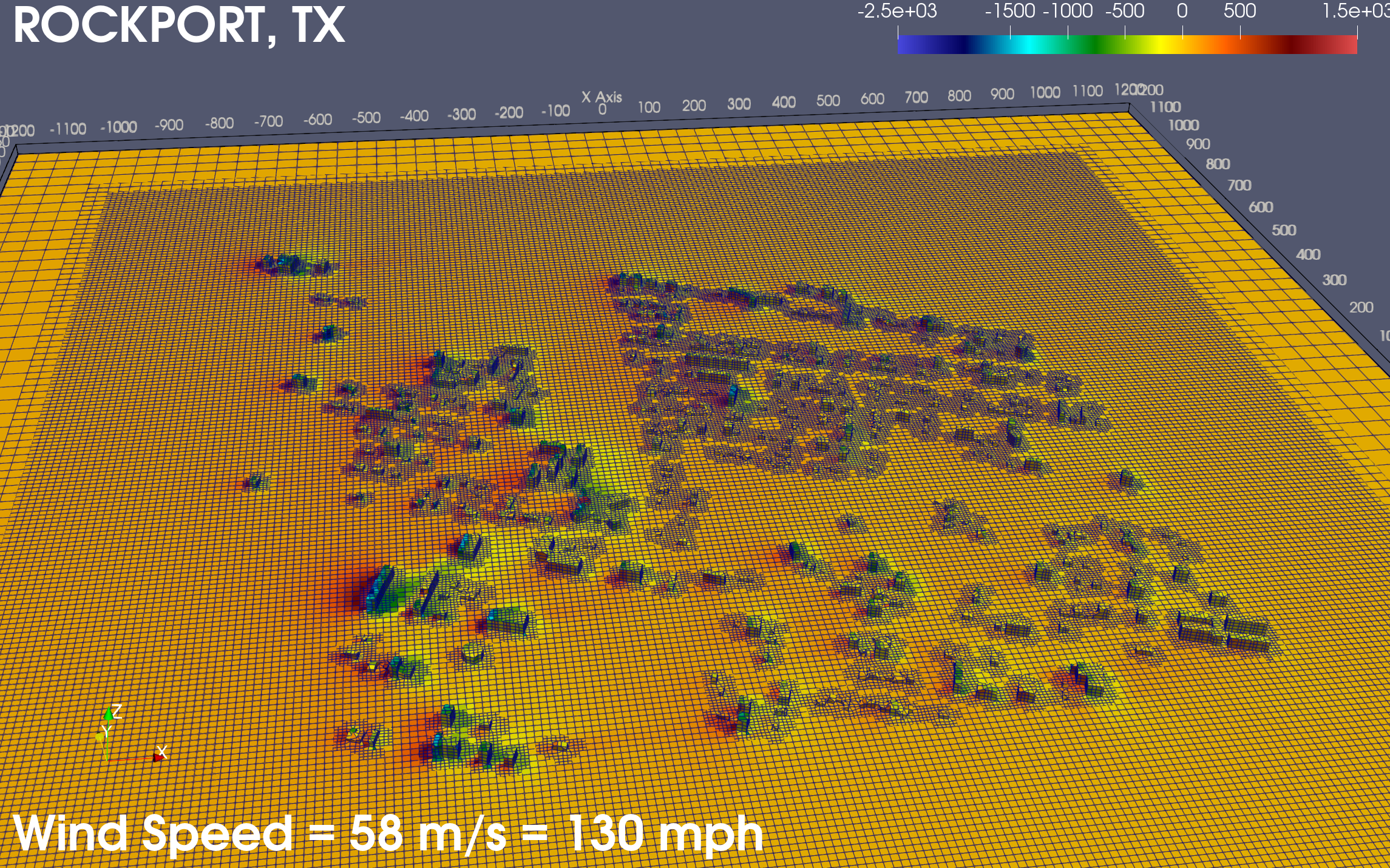

Wind simulation

Modeling impacts of Category-4 level storm: Hurricane Harvey in 2017 for both Houston and Rockport, Texas. 450+ buildings, structures, and homes simulated.

From climate risks to climate forces to damage.

End-to-end.

Orbyfy Physics-AI Digital Twins™️ use the most accurate 3D models of a portfolio, region, or geographic zone to simulate climate risks on buildings, structures, and homes. Translating climate risks to climate forces and damage categories. Assess acute physical climate risk impacts via digital twin simulations. Orbyfy’s mission is to be the leading earth observation climate digital twin platform. Find out more regarding how to get started.

Hurricane and wind impact simulations

Flooding and hydrodynamic simulations

Hail and impingement simulations

Fire and thermodynamic effect simulations

Drought simulations

Earthquake and vibrational impacts simulations

Erosion and coastal effects simulation

Orbyfy uses 3D building, structure, home, and terrain data in conjunction with physics-informed AI to simulate real-world impacts of acute physical climate risk.

Benefits of Orbyfy Physics-AI Digital Twins™️

Unmatched Detail: Simulate building surfaces and complex structures, including their influence on each other.

Scalability: Define risk for individual buildings, entire cities, or even vast geographical regions.

High-Fidelity Analysis: Handle intricate urban environments and account for the impact of terrain.

Comprehensive Risk Assessment: Model the effects of various climate threats like hurricanes, floods, and fires on target asset and loan portfolios.

Advanced AI Insights: Leverage cutting-edge AI to understand how buildings respond to climate forces.

Flexible Material Modeling: Approximate the composition of buildings (concrete, steel, wood, etc.) for accurate simulations.

Actionable Outputs: Generate insightful visualizations, run what-if scenarios, and create location-specific reports.

Prioritized Risk Management: Get a clear picture of relative risk across your portfolio, highlighting critical areas.

Future-Proof Planning: Utilize worst-case historical data to stress-test your assets against future climate projections.

White Paper

Quantifying Acute Physical Climate Risk Re-Imagined: A Deep-Dive into 3D Climate Digital Twins

Partnerships